Where Did The Buyers Go?

There are several ways to quickly break down how a market is performing. One of the simplest methods is simply tracking the number of sales compared to the 10-year average. Or as you make your way around town, make note of the number of For Sale signs versus Sold signs.

For example, in 2021, when the average days on the market approached single digits (meaning, on average, all homes were selling in 8 or 9 days), For Sale signs weren’t up for very long. Flip the calendar to 2023 and we saw a different story. As days on the market suddenly averaged 60 to 75 days, For Sale signs started to rust they were out so long.

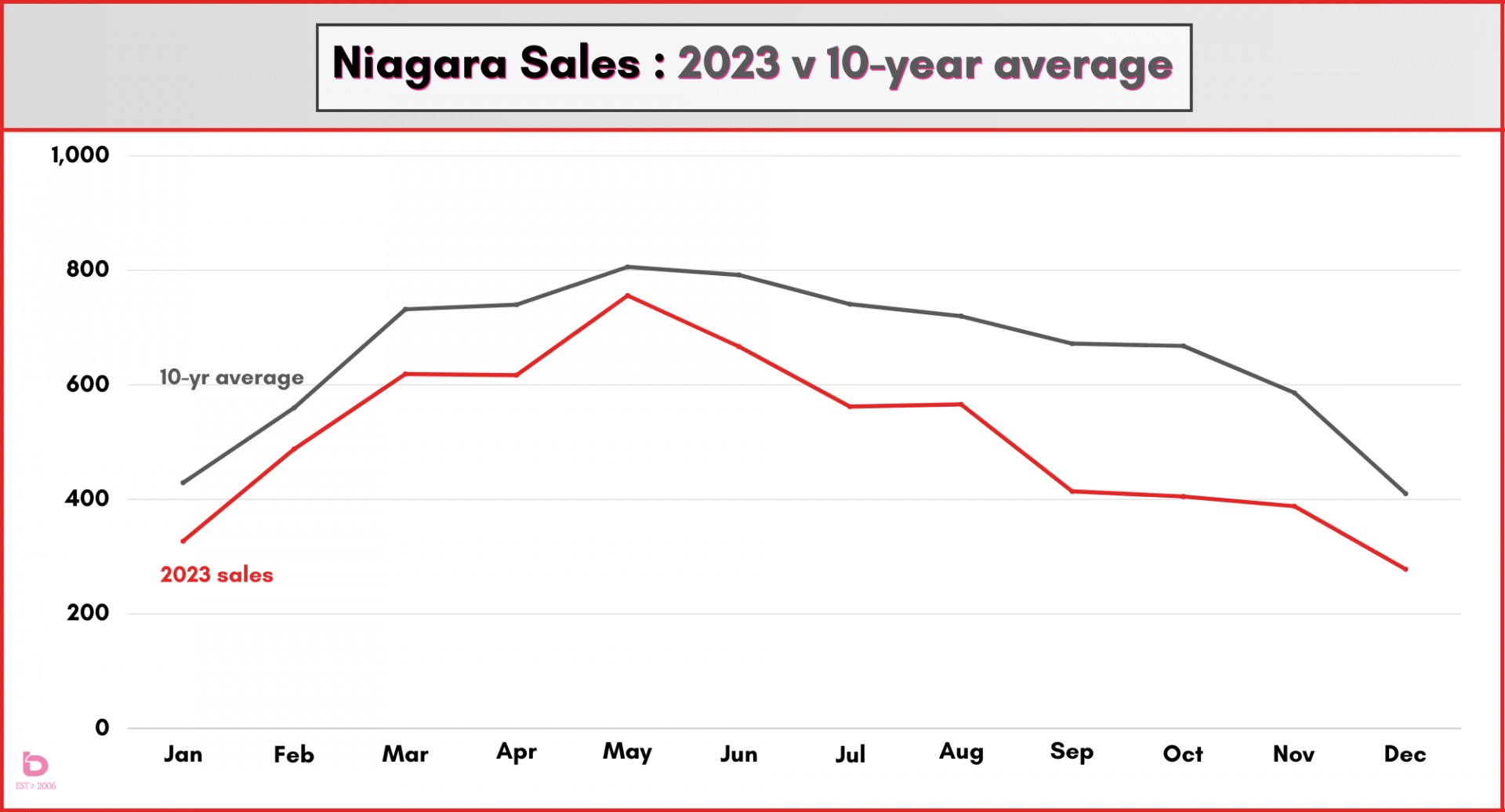

So how bad was it? In a nutshell, sales were down. And as the year progressed, they were down further yet. Comparatively, the last four months of 2023 were the weakest with sales running 30 – 40% below the 10-year average.

The Numbers

Over the past 10-years, Niagara averaged 7,854 sales per year. Meanwhile 2023 came in at 6,087 sales, 22.5% off of the 10-year avearge.

Not to get dramatic, but 2023 was a last place finisher for annual number of homes sold. The previous low was the global financial meltdown year of 2008 which came in at 6,102 sales. So, on a positive note, it can only get better. Right?

What makes the sales slump of 2022 and 2023 all the more impactful was that only 2 years ago, 2021 set an all-time, gold medal wining record of 10,049 sales. Imagine going from the highest all-time to the lowest all-time in just 2 years. That is why this market continues to cause whiplash, winners and losers.

To Put It Into Context...

Have a look at this graph. It shows the monthly sales in 2023 compared to the 10-year average for each month. You'll see that while sales in 2023 were down, they still followed the same overall trajectory of the 10-year avearge.

The reason was quite simply linked to buyer confidence and overall market sentiment. After 10 interest rate increases (through 2022 and 2023), the cost of home ownership became more challenging for many. As the rates increased, many buyers found themselves unable to qualify for what they wanted so they elected to wait things out. The result was far fewer people participating in the marketplace.

And that is what makes 2024 such an interesting prospect. While the interest rate increases of June and July 2023 were only .25%, the sudden impact they had on the market was notable. Fast forward to when rates are decreased, even only a little bit, will that have the inverse effect on market activity?

Watch out for buyer activity and home sales as we head into summer and the expected rate decrease(s).

And yes, we may be proven wrong on that, but at some point, the market will find its footing and sales will return.

Want to discuss further? Click here.