What Exactly Is Going On?

Before we even get started, it’s important to note this one thing.

All markets change. It’s what they do. Change doesn’t necessarily mean bad. It just means different.

Especially after a market like we just went through, a transition of some sort was inevitable. Whether it’s a market, a marathon runner or an engine, things can only run flat-out for so long.

So, with that said, let's have a look at the current state of the Niagara Real Estate Market...

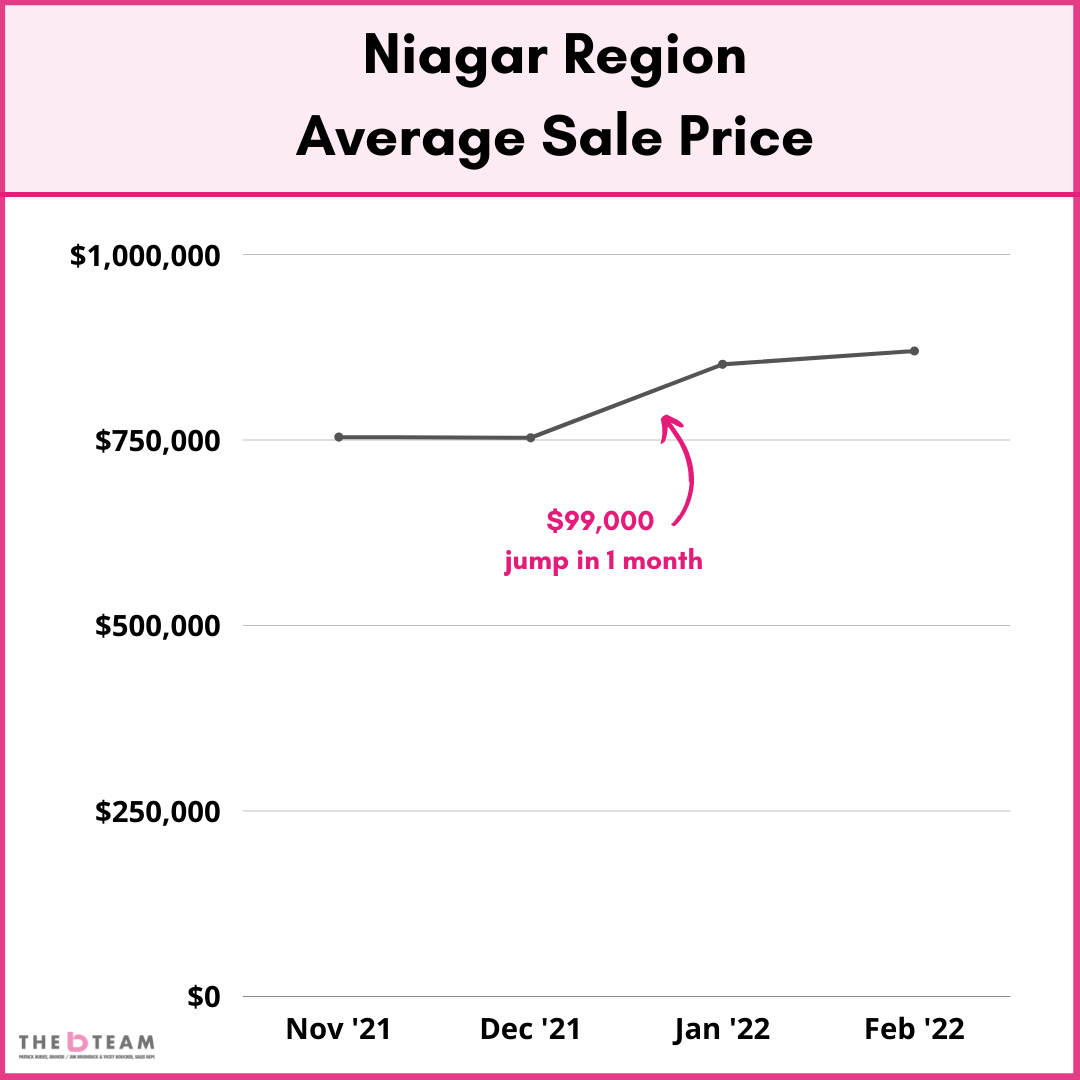

November 2021 to February 2022. The Precursor.

The margin between the number of homes for sale (supply) and the number of people who wanted to buy those houses (demand) was tight in November 2021 through February 2022. The result was one of the biggest sale price escalations that we’ve ever seen.

This graph shows the average sale price for Niagara Region between November through February.

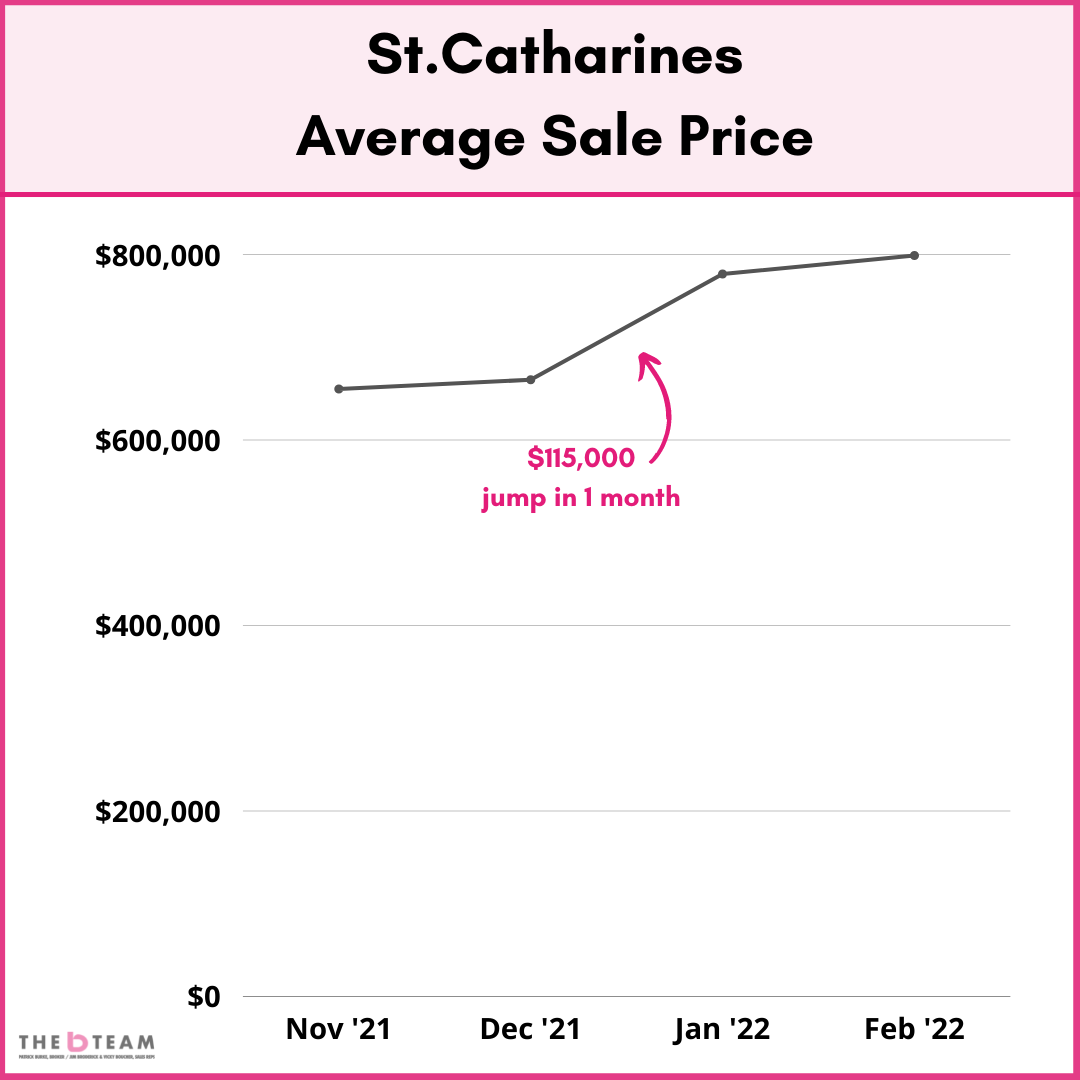

And St.Catharines saw an even bigger jump in sale price, going up 17% from December to January, the biggest one month increase on record.

Why did that happen? Keep reading.

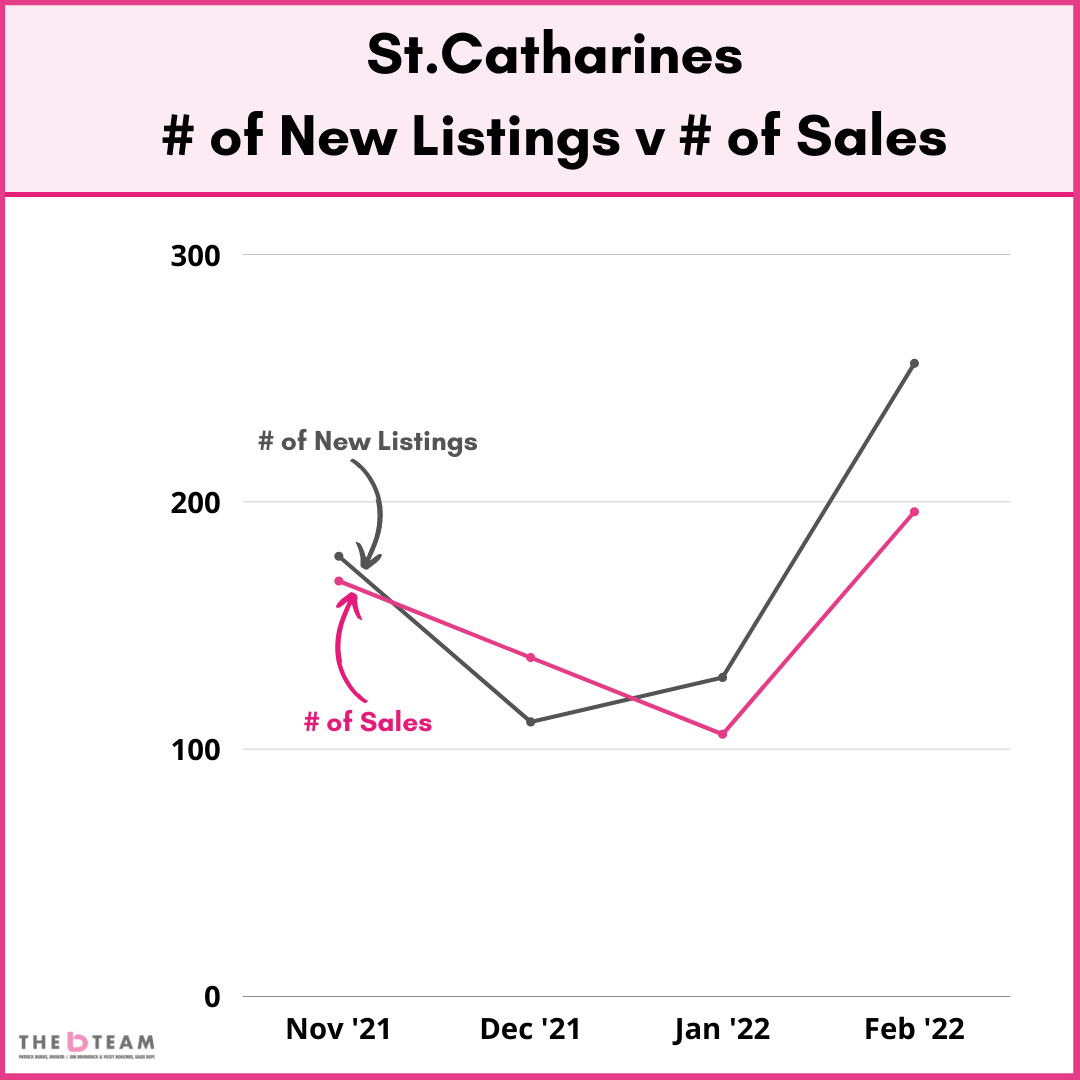

Not Enough Stock on the Shelf!

Typically, there is a gap or cushion between how many homes are listed for sale in a month and how many are sold. In a typical market, you might expect 1.5 or 2 new listings per sale.

Meaning, in a typical month, if there are 300 new listings, there might be 180 or 190 sales, with 110 or 120 listings carrying forward and remaining on the market. That is a normal market where buyers can get home inspections, take a breather and make a more comfortable decision.

Along came 2022, when some months had more sales than new listings. That’s a problem.

For example, this graph shows you the number of new listings (in black) and the number of sales (in pink) from that same time period (Nov 2021 through Feb 2022) in St.Catharines.

Note: Here is the issue. For the 3-month time period from November through January, there was an equal number of sales and listings. No margin or cushion of extra listings available for the buyer. You can see in the graph above that normalcy started to return in February where we moved back towards a healthier balance.

Along Came Spring

As we get into March - May, an increase in market activity is normal. It happens every spring. So, the steady increase in new listings as we moved into March and April was to be expected, for the most part anyway.

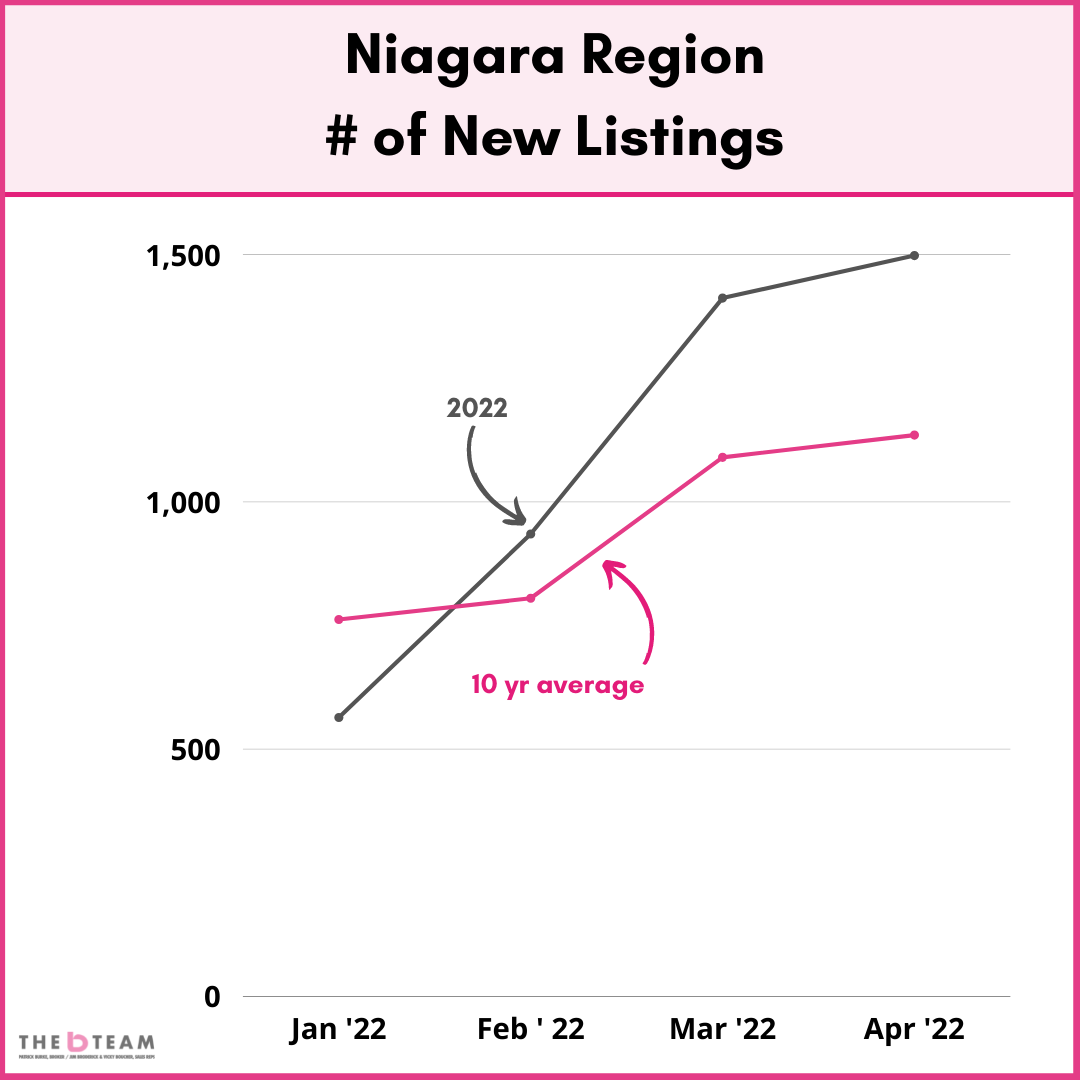

This graph shows you the monthly number of new listings in Niagara for 2022 (in black) and also the 10-year average (in pink).

You can see how weak January was in comparison to what was normal over the last 10 years. In fact, excluding the month of December (typically a very low new listing month), January 2022 was the worst month on record in modern timres for the number of homes listed for sale in any month.

Then we had significant inventory build into March and April. In fact, April 2022 posted the 2nd highest number of new listings for ANY month while March 2022 posted the 4th highest total.

A Market Flip Flop

Through the end of 2021 into early 2022, the market was characterized by this:

A long line-up of motivated buyers trying to buy homes in a market that didn’t have enough homes for sale.

High demand. Low(ish) supply.

Then came the market flip-flop. As we moved into April, we started to feel the effects of 2 things happening at the same time.

Increasing supply while the demand for that inventory started to taper off.

Lower demand. Increasing supply.

Need supply? Well, April 2022 now holds 2nd place all-time for any month, with 1,498 homes listed for sale. (March 2021 remains in first place with 1,579 new listings)

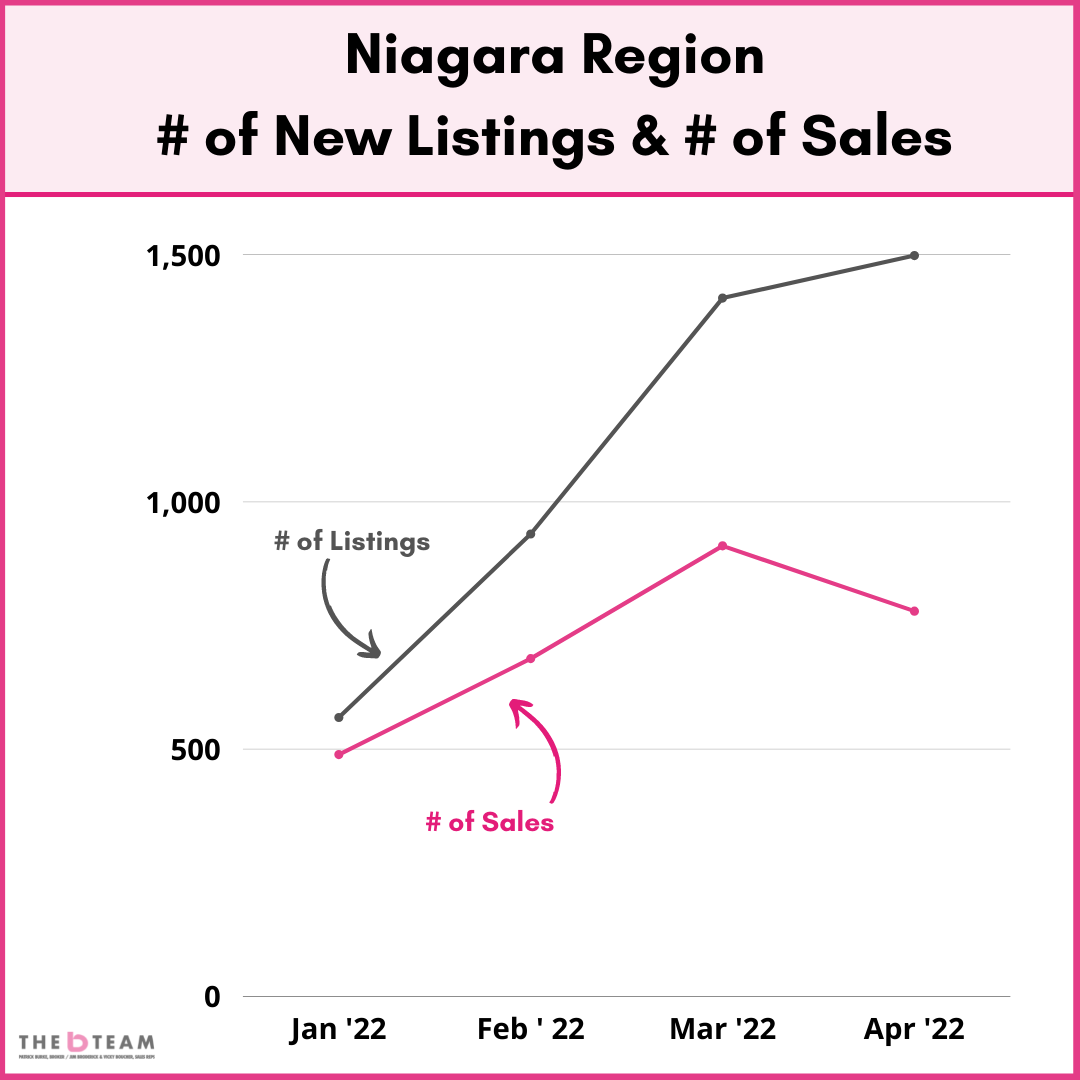

This graph shows the change in relationship between supply & demand very well:

Notice how the lines went in opposite directions with huge growth in listing inventory over sales in April 2022.

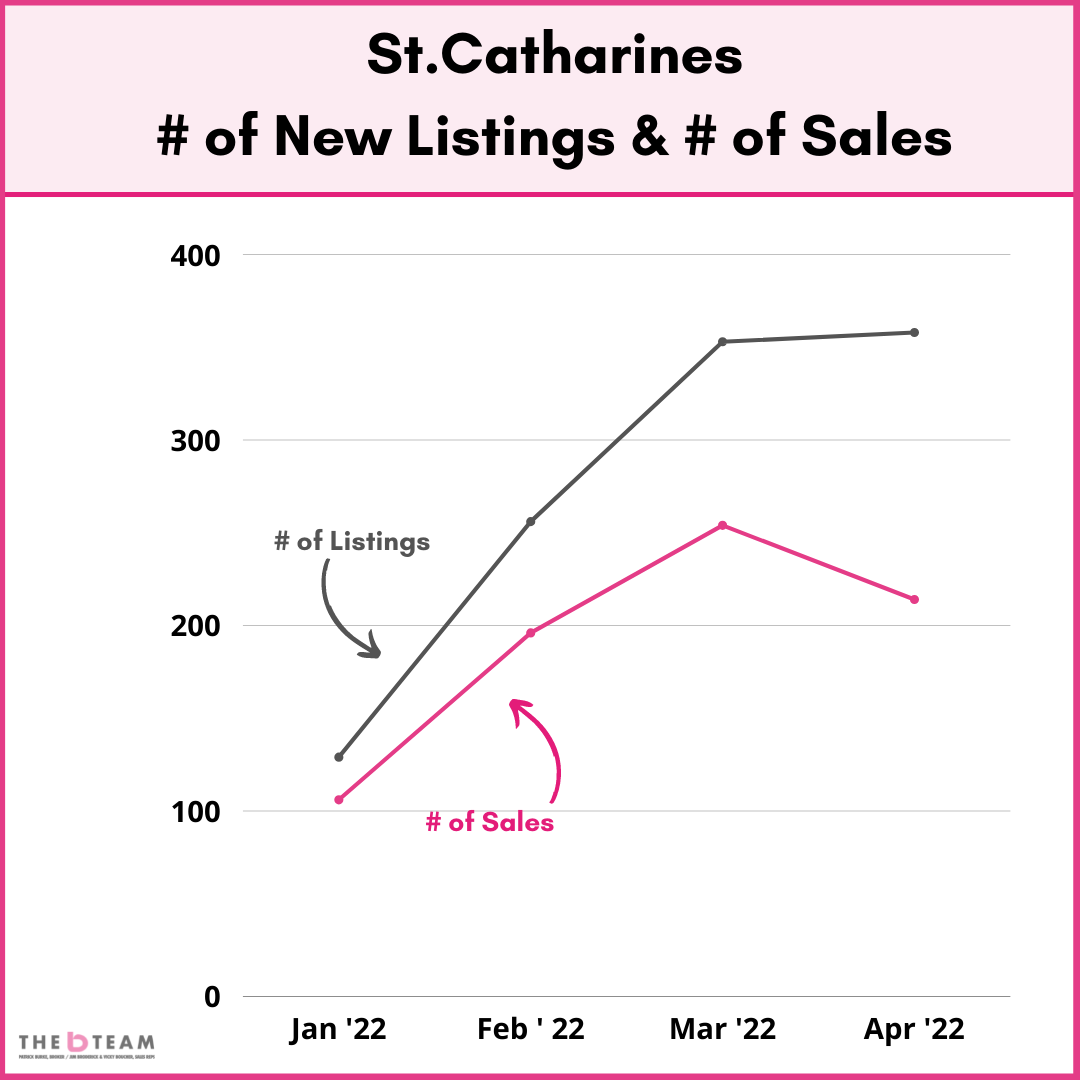

St.Catharines tells a similar story:

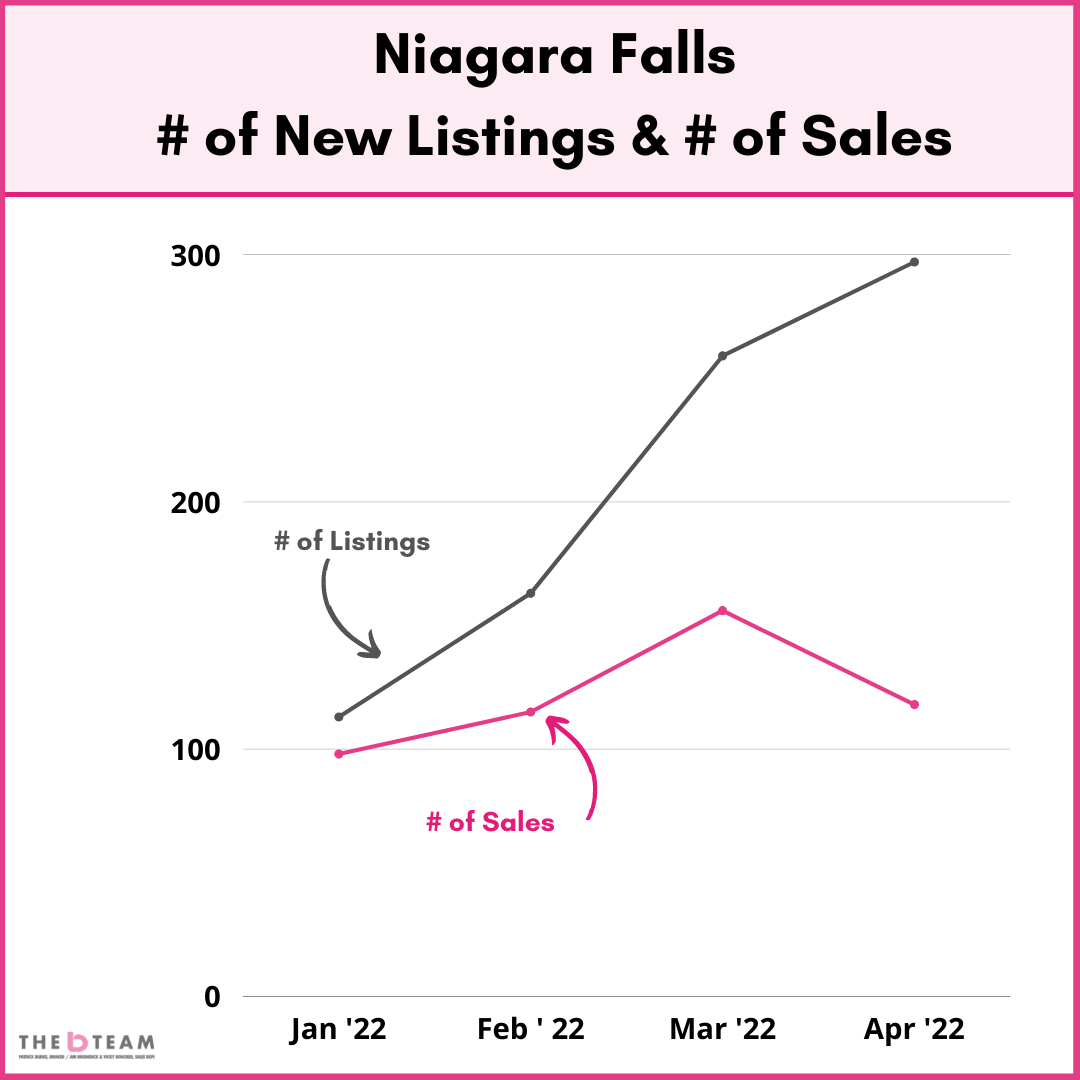

Niagara Falls? Same deal:

In a nutshell, the market is showing signs of the impact that growing inventory can have. Add to that a tapering off in demand and you can expect a few things to happen. So, in conclusion…

Where do we go from here?

It’s a reasonable expectation that the market data is about to change.

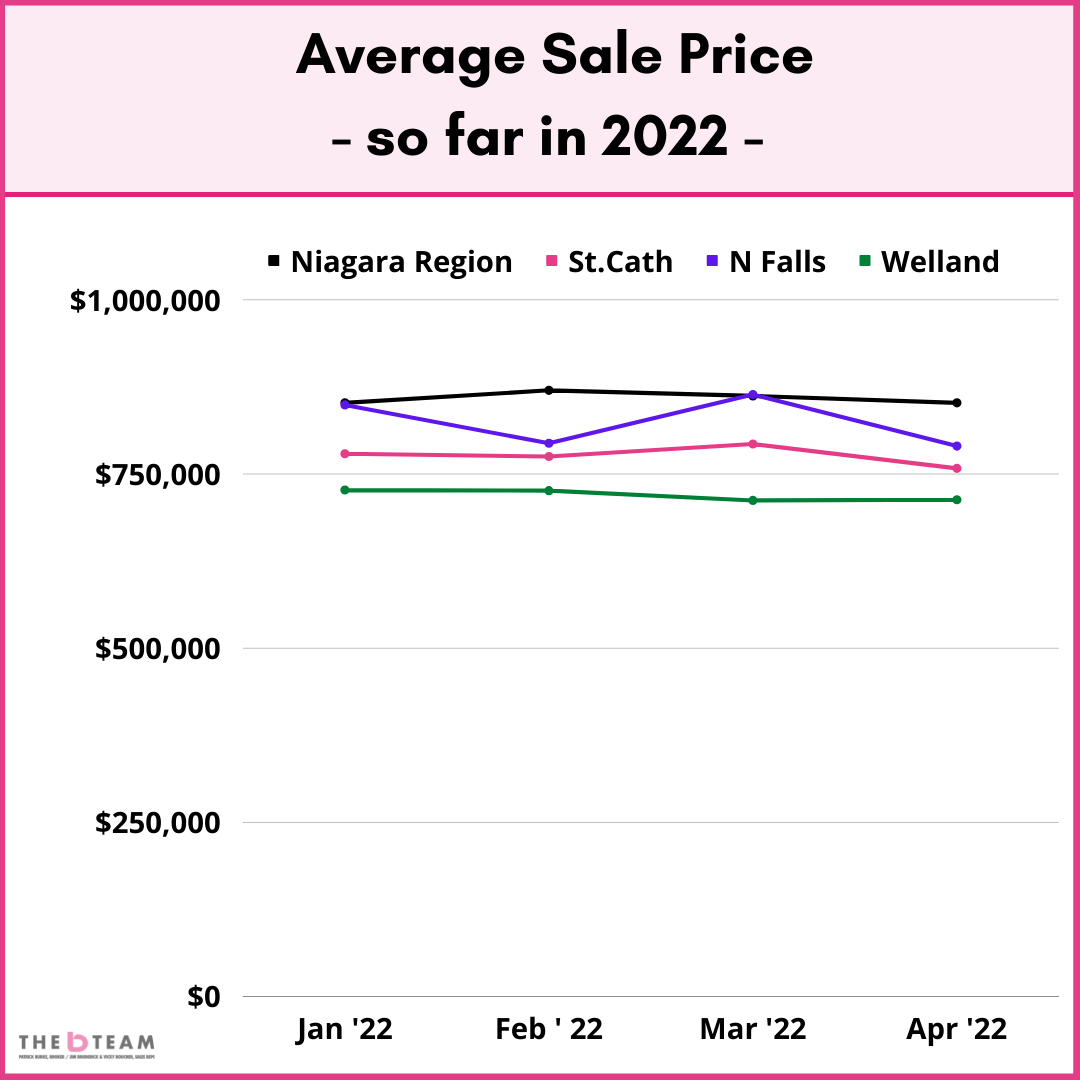

Price: Average Sale Prices are widely expected to ease back over the next several months. This graph shows you year-to-date for Niagara and several cities:

You’ll see that in general, prices are either flat or easing back. This is the overall trend that we expect to see in the coming months as well.

Days on Market: The time it takes to sell a home should return up into the 20+ days as we get into summer. After coming out of a market that was in the single digits for days on market, 20+ will feel uncomfortable for both sellers and their Realtors. Patience and strategy will be key.

Demand: A combination of interest rate increases and more difficult rules surrounding investment properties should impact many segments of the buyers side, including investors and those who are going to show caution in the face of new mortgage rates.

Supply: Post-COVID, there are many who are planning on selling in the next 6 - 12 months who did not during the 2020 - 2021 COVID markets. Add to that, those who are looking to sell before any perceived price change as well as the typical bump in activity due to spring.

Buy & Sell in Same Market: For those looking to buy and sell, the price dynamics will play a factor as well as people consider how to time the market. In a stable market, buy and sell in the same market and you can typically make up any perceived shortcoming on the purchase side provided both houses are in the same market conditions. The challenge will be the uncertainty and strategy around navigating that process.

May 2022 should provide a lot of clarity for where the market is sitting. After a buzzing January - March, the next few months (April and May) are expected to produce significantly different activity and overall dynamics. Rest assured we'll be here tracking and monitoring.

As always, your questions are always welcome.

Want to learn more? Contact us & we can chat.