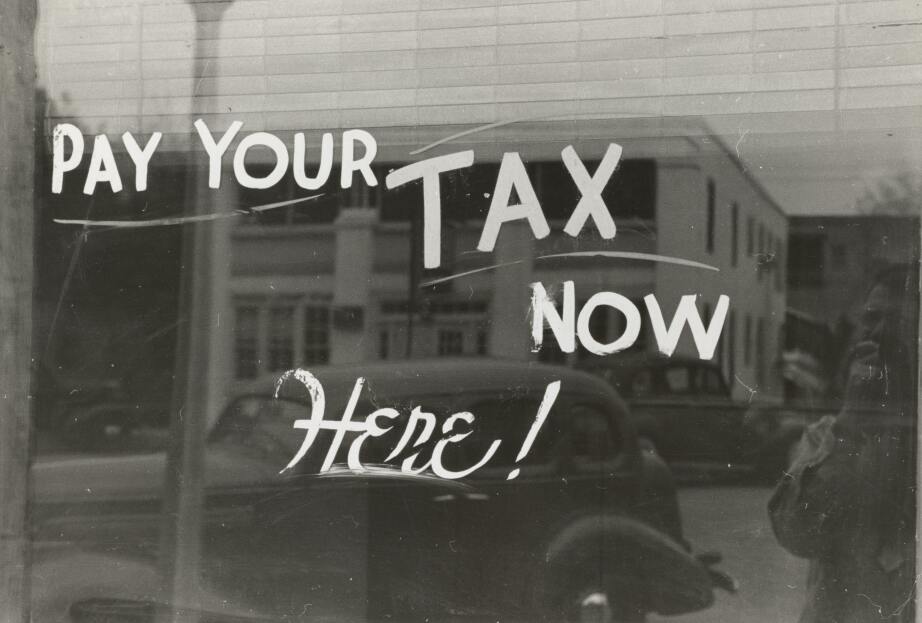

Former American Supreme Court Justice Oliver Wendell Holmes Jr. is quoted as saying “Taxes are the price we pay for civilized society.”

And he couldn’t have been more concise.

Regardless of your opinion on the subject, it is important to understand that paying taxes is our way of contributing to the greater of good of society. To the vibrancy of our communities. And to secure the safety and health of the places we live, work and play.

While there are many types, for the purposes of this b-LOG, we will be focusing on property taxes and the basics behind them.

But first a little history.

The first recorded tax in Canada dates back to 1650 when an export tax of 50 per cent on all beaver pelts and 10 per cent on moose hides was levied on the residents of New France (now the Province of Quebec).

It was the Constitution Act, 1867 (formerly BNA Act) that gave Parliament unlimited taxing powers and restricted those of the provinces to mainly direct taxation including taxes on income and property. The federal government was responsible for national defence and economic development while the provinces for education, health, social welfare and local matters.

So how is the amount of property tax we pay determined?

Simply said, this is the result of a calculation based on four factors:

- The Market Value assessment of a provided (provided by MPAC - Municipal Property Assessment Corporation)

- The Tax Class into which a property falls

- The Tax Rate for the applicable tax class (set annually by Council)

- The Tax Rate for education portion of that class (set annually by the Province of Ontario)

We will discuss how MPAC assesses properties later in the b-LOG.

But for now, let’s look at how your property taxes are used or allocated in the Niagara Region.

A property owner in St. Catharines with an assessed value of $400,000 in 2017, will pay property taxes in the amount of $6,291.02. Of that, taxes are broken up into the following:

Niagara Region Taxes: $2,581.82 (41.04% of the total property tax)

Municipal Taxes: $2,435.69 (38.72% of the total property tax)

Education Taxes: $716.00 (11.38% of the total property tax)

Hospital Taxes: $533.88 (8.49% of the total property tax)

Infrastructure Levy: $23.64 (0.38% of the total property tax)

The Niagara Region portion of 41.04% is allocated as follows:

Fire Protection: $560.21 (23%)

Roads, Walkways & Storm Sewers: $524.89 (21.55%)

Parks, Recreation & Culture: $471.79 (19.37%)

Corporate & Government Services: $314.45 (12.91%)

Transit & Paratransit: $250.63 (10.29%)

Libraries: $120.81 (4.96%)

Planning & Building Services: $56.51 (2.32%)

Meridian Centre: $46.77 (1.92%)

Capital Projects Allocation: $34.34 (1.41%)

FirstOntario Performing Arts: $32.15 (1.32%)

Economic Development & Tourism: $23.14 (0.95%)

Source: City of St. Catharines

Now that we know how taxes are allocated, let's talk about who MPAC is and how they assess a property's value.

MPAC is an independent, not-for-profit corporation funded by all Ontario municipalities, accountable to the province, municipalities and property taxpayers through its 13-member Board of Directors. Their role is to accurately access and classify all properties in Ontario in compliance with the Assessment Act and regulations set by the Government of Ontario.

MPAC uses one of three recognized approaches to establish an assessed value for properties:

Direct Comparison (single family, condominium and vacant land property types) Income Approach (industrial malls, medical, office, retail, shopping centres and sports stadiums) Cost Approach (general purpose industrial, grain elevators, gravel pits, marinas and warehousing)

Source: MPAC

We hope this helps shed some light on property taxes in the Niagara Region and how they benefit the growth and maintenance of our communities. The Niagara Region has a property tax calculator on their website here.

Subscribe to our b-LOG using the form on the right for updates on future posts.

Photo courtesy of New York Public Library

Useful Links: MPAC - Municipal Property Assessment Corporation How Property Assessments Affect Property Taxes - Niagara Region Niagara Region Property Tax Calculator